What Depreciation Method Does Under Armour Use

1157083 A 340161 L 816922 SE Liabilities of Assets. Although the amount and how quickly.

Statement Of Cash Flows Ppt Download

3401611157083 x 100 2940.

. Under Armour has agreed to pay 9 million to settle the action. 8169221157083 x 100 7060. Additionally who is the auditor of under Armour.

Depreciation can occur as a result of age general use or obsolescence. Refer to the statement of cash flows. During the year ended the Company changed its method of determining cost for substantially all of its U.

Under armour accumulated depreciation calculation the cumulative depreciation of an asset up to a single point in its life. Depreciation occurs when an item experiences a loss of value. Regardless of the method used to calculate it the depreciation of an asset during a single period is added to the previous periods accumulated depreciation to get the current accumulated depreciation.

Cost of a tangible asset Residual value Useful life of the asset. With misleading investors as to the bases of its revenue growth and failing to disclose known uncertainties concerning its future revenue prospects. This is to represent assets that will quickly decline in value in the first months or years of their useful lives such as cars or computers.

Could the company use depreciation. For Under Armour total liabilities as a percentage of total assets is 2940 while total SE as a percentage of total assets is 7060. In accounting depreciation is a noncash expense that reduces the value of an asset.

Under the General Depreciation System GDS method most tangible property is assigned to one of eight main property classes. Click to read further detail. Property plant and equipment gross increased from 2019 to 2020 and from 2020 to 2021.

Under Armour values their inventory at standard cost using the FIFO Method of cost determination. With regard to depreciation methods. Adidas costs its inventory under the weighted average method while Under Armour uses FIFO.

Amount after accumulated depreciation depletion and amortization of physical assets used in the normal conduct of business to produce goods and services and not intended for resale. Over what range of useful lives does Under Armour depreciate various types of fixed assets. You face specific challenges that require solutions based on experience.

What depreciation method does Under Armour use. This method of calculating depreciation aka the declining balance method places greater reductions in value earlier on in the assets life. Depletion and amortization are synonyms for depreciation.

What method of depreciation does your company use. Returning to the real business people introduced in the first course this second course describes. Property Plant and Equipment is depreciated using the straight-line method of depreciation over the estimated useful life of the asset.

You can find discussions of this in Note 2 Summary of Significant Accounting Policies. What type of inventory does Nike have. What are the typical useful lives of each companys operating assets.

In straight-line depreciation the expense amount is the. Also according to Note 2 what depreciation method does Under Armour use for financial reporting for its Property and Equipment. In this manner what depreciation method does Nike use.

Under Armour or Sketchers to analyze its financial strengths and weaknesses assess its. Nike uses the straight-line method for buildings and leasehold improvements machinery equipment and software. What effect will the useful lives have on the companys financial statements.

The Securities and Exchange Commission today charged sports apparel manufacturer Under Armour Inc. SE of Assets. Straight-line depreciation Straight Line Depreciation Straight line depreciation is the most commonly used and easiest method for allocating depreciation of an asset.

What depreciation method does Columbia use. In this way what depreciation method does under Armour use. Under Armour values their inventory at standard cost using the FIFO method of cost determination.

Review the information in Note 3 Property and Equipment Net. The actual profit or loss on the sale of fixed assets are determined by deducting the total depreciation from the purchase value. The WSJ story doesnt mention Under Armours auditor PwC nor the partner responsible for the.

With the straight line is a very common and the simplest method of calculating depreciation expense. To determine the depreciation method to use refer to the Depreciation Methods table. The method of depreciation that reduces the value of asset in an equal proportion is known as straight-line method of depreciation.

Which depreciation method does Under Armour use. Inventories are valued on a Ñrst-in Ñrst-out FIFO basis. The fixed assets are depreciated to determine the end value.

Washington DC May 3 2021. The following is a list of the property classes and examples of the types of property included in each class. Which depreciation method does Under Armour use.

We sell our branded apparel footwear and accessories in North America through our wholesale and direct to consumer channels. Under Armour uses the. When you use a nonrecovery method enter the life in Life or Class Life in the Depreciation 4562 screen.

The cumulative depreciation of an asset up to a single point in its life. It is the simplest method of depreciation. The straight-line depreciation method is a simple calculation dividing the depreciable value the asset cost the residual value over the years of active life.

The term depreciation is used when discussing man made tangible assets. Nike likely uses accelerated depreication methods for income tax reporting even though it uses straight-line methods for financial reporting. Under Armour Accumulated Depreciation Calculation.

Under Armour Depreciation Depletion and Amortization Calculation Depreciation is a present expense that accounts for the past cost of an asset that is now providing benefits. All 3 assets are considered to be nonfarm 5 and 7 year properties so we will use the GDS using 200 DB method. To determine the depreciation rate table to use for each asset refer to the MACRS Percentage Table Guide.

Using the footnotes in the annual report find the depreciation method that the company uses and the estimated useful lives of the assets. Property plant and equipment net. In this method depreciation expense is equally distributed throughout the useful life of the asset.

All 3 assets will use Table A-1. The depreciation assumption is thus the same number every year for the number of years the asset is considered to be in use. What method does the company use to present cash from or to operating.

Under armour ua anticipates higher inventory growth over the next. List the categories of Under Armours property. Inventories from last-in Ñrst-out LIFO to FIFO.

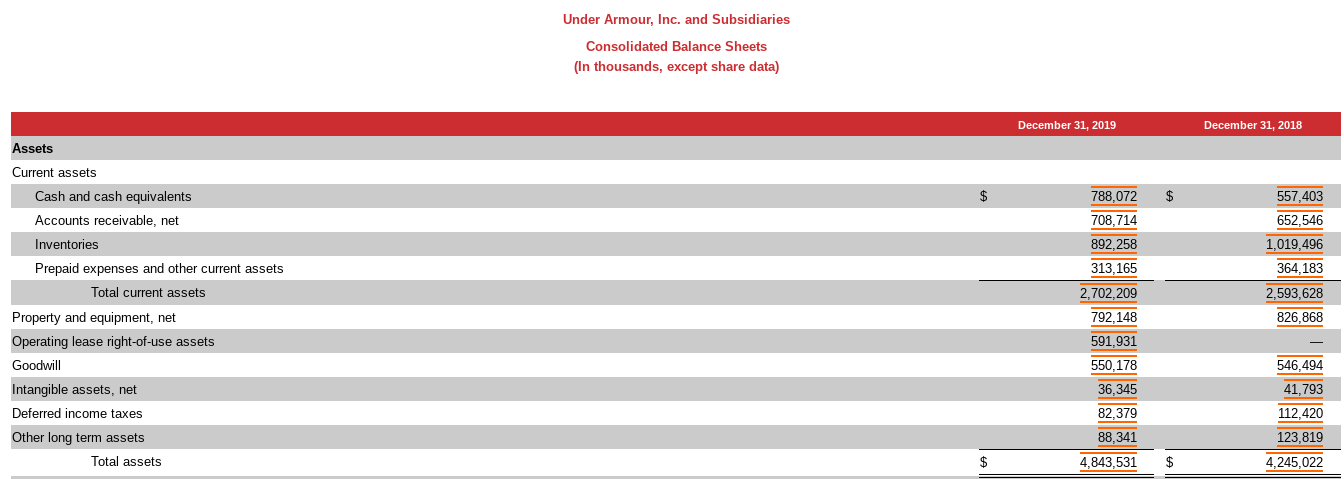

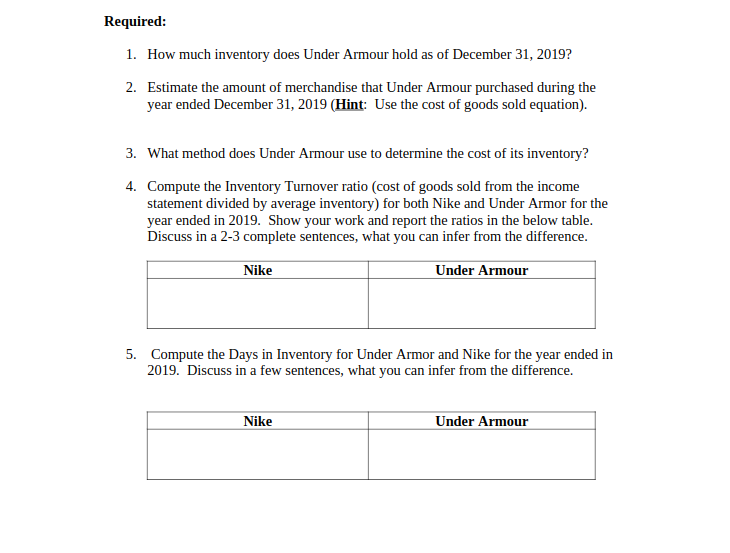

Solved Required 1 How Much Inventory Does Under Armour Chegg Com

Under Armour Research Project By Janet Song Issuu

Solved Required 1 How Much Inventory Does Under Armour Chegg Com

No comments for "What Depreciation Method Does Under Armour Use"

Post a Comment